by Meredith A. Levine

The Economic Forum is a state-mandated panel that convenes periodically to submit revenue projections for the General Fund—Nevada’s major operating fund—to the Governor and the Legislature. It is a five-member committee drawn from the private sector, with three members selected by the Governor and one nominated by each the Assembly and Senate.

The Economic Forum meets in December of even-numbered years to provide an official forecast for the unrestricted revenue portion of the General Fund. That forecast is binding on the Governor’s Recommended Budget for the forthcoming biennium. The Forum also typically convenes about a month before the official forecast to hear testimony on the economic outlook and preliminary General Fund estimates from the Budget Division (Governor’s Office of Finance), the Fiscal Analysis Division (Legislative Counsel Bureau), and certain Executive Branch agencies (the Department of Taxation and the Gaming Control Board).

The Economic Forum met on November 8, 2018. In this overview of the meeting, we discuss what the preliminary forecast suggests for economic expectations in the Silver State.

THE ECONOMIC OUTLOOK

In general, positive indicators signify robust economic conditions in the short term—that is, through fiscal year (FY) 2019—with long-term signals of economic softening beginning in FY 2020 as the national economy contracts as part of the “natural” business cycle.

The national economy, and, by extension, Nevada’s economy, is benefiting from dual fiscal stimuli. The Tax Cuts and Jobs Act (TCJA) of 2017 and discretionary spending by the federal government, collectively, are expected to help sustain economic health through FY 2019. However, federal discretionary spending is projected to decrease as a share of Gross Domestic Product (GDP) in FY 2020. And that is when a national contraction is expected, as noted above, with the country about 10 years out from the Great Recession. Nevada’s economy is cyclical, or especially sensitive to periods of prosperity (boom) and austerity (contraction/recession), so it may feel the recessionary effects. Moreover, the yield curve, which signals investors’ expectations regarding interest rates, may be exhibiting signs of inversion (i.e., a downward slope). This reflects a sense that the Federal Reserve may cut interest rates. Many economists view inverted yield curves as harbingers of recession.

Yet, other factors may provide a cushion in Nevada if the country slides into a downturn. For example, personal income in Nevada had the third-strongest gain in the nation in the second quarter of 2018; “reached $145 billion, up 5.8 [percent] % from a year ago”; and, on average, “has exceeded that for the U.S. over 16 of the past 18 quarters.”

A strong job market, in which Nevada’s labor force growth is outpacing other western states and the U.S. average, may help buffer the state from national economic forces. Specifically, labor demand currently outstrips supply, contributing to wage growth, which means that there is slack in the market that may withstand an influx of people from other parts of the country that are more affected by a contracting or even recessionary economy. However, that could create an oversupply problem, leading to possible wage pressure.

PRELIMINARY GENERAL FUND REVENUES FORECAST

As noted previously, the Budget Division, the Fiscal Analysis Division, and certain Executive Branch agencies (where applicable) provide forecasts to the Economic Forum for certain major revenue funds. A major fund is one in which its “total assets, liabilities, revenues, or expenditures/expenses… are at least 10 percent of the corresponding total for all funds of that category or type.” At the December meeting, when the estimates will have been revised, Forum members will select a single forecast for each major fund, which binds on the Governor’s Recommended Budget. For example, at the December 6, 2016, meeting of the Economic Forum, members voted unanimously on the Fiscal Analysis Division’s forecast for the Sales Tax but the Budget Division’s forecast for the Insurance Premium Tax.

Thus, the biennial revenue estimates have yet to be determined, though Budget, Fiscal, and Agency have provided preliminary forecasts. Space constraints limit our ability to assess each revenue category, but overall, we have a sense of the lower and upper bounds of the forecast for total General Fund revenue for the biennium (i.e., FY 2020 and FY 2021), after tax credits. The Budget Division had the lowest forecasts for each fiscal year, at about $4.3 billion ($4,323,565,283) for FY 2020 and $4.5 billion ($4,460,324,792) for FY 2021, while the Fiscal Analysis division had the highest forecasts, at approximately $4.3 billion ($4,336,246,244) and $4.5 billion ($4,535,470,376) for those respective fiscal years.

In total, if little or nothing changes between the November 2018 meeting of the Economic Forum and the December 2018 meeting, then total General Fund revenue for FY 2020 and FY 2021 is expected to range from $8.8 billion to $8.9 billion. To put this into perspective, General Fund revenue for the 2017-2019 biennium (i.e., FY 2018 and FY 2019) is $7.9 billion ($7,930,220,817). If the highest total forecasted amount were approved, it would translate into an 11.9 percent increase in General Fund revenue for the upcoming biennium over the current biennium. For the lowest forecasted amount, it would represent a 10.8 percent increase in General Fund revenue over the previous biennium.

While the November 2018 forecast report does not contain the approved amounts for specific revenue line items for the 2019-2021 biennium, it does provide a comparison of year-to-date actual revenues, or “actuals,” for FY 2018 with that of FY 2019 for select revenue sources. Given that Nevada’s economy currently is exhibiting signs of strength but may experience some contraction in FY 2020, a year-over-year comparison of funding streams is useful for analysis.

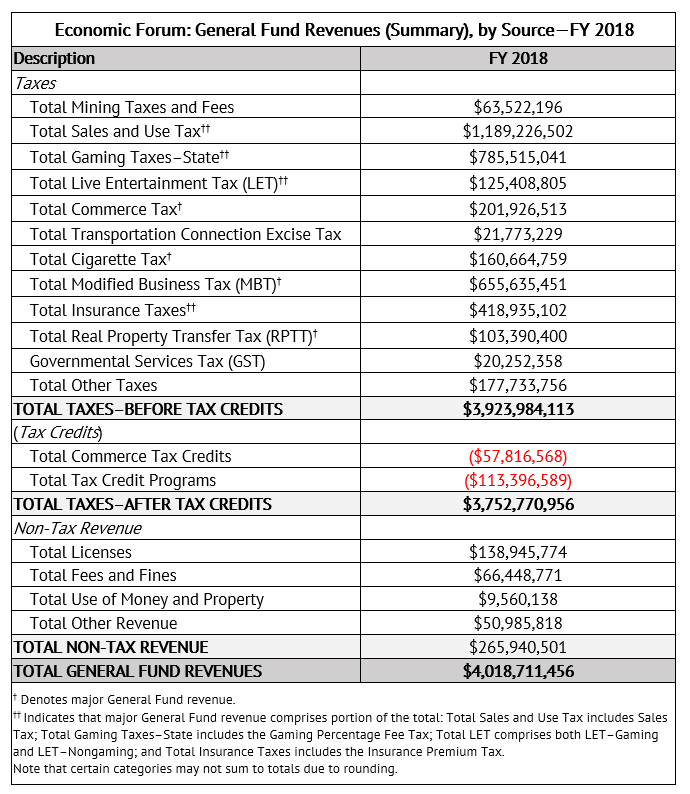

Table 1 presents FY 2018 and FY 2019 “actuals” through October, by source, at the summary category level. (See Appendix A for total General Fund revenues for FY 2018, by source, at the summary category level.)

Table 1. Economic Forum: General Fund Revenues (Summary)—FY 2018 vs. FY 2019 Year-to-Date Through October

Source: Nevada Economic Forum Meeting Packet (November 8, 2018)

All tax categories, with the exception of gaming taxes and the live entertainment tax (LET), have increased in FY 2019 versus the same time frame in FY 2018. Gaming taxes decreased by 3.7 percent, and the LET decreased by 4.5 percent. A decrease in table game win on the Las Vegas Strip, resulting in weaker revenue—as reported in October—is at least partially responsible for the approximately $9.6 million dollar difference from FY 2018. There are several reasons for the $1.4 million decline in the LET, but as Michael Lawton, a senior research analyst with the Nevada Gaming Control Board, explained to members of the Economic Forum, some Strip properties have reported weak attendance at late-night attractions. As the LET is paid by venues for live entertainment events, difficulties in enticing visitors to shows, concerts, et cetera, could have contributed to the revenue decrease. Outside of other revenue, though, all non-tax revenue decreased in FY 2019, relative to the same period in FY 2018.

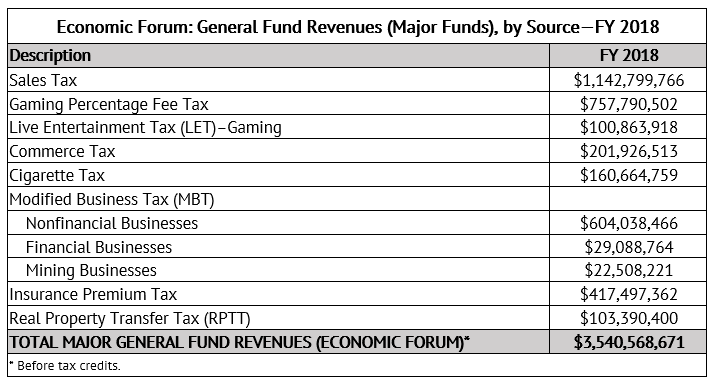

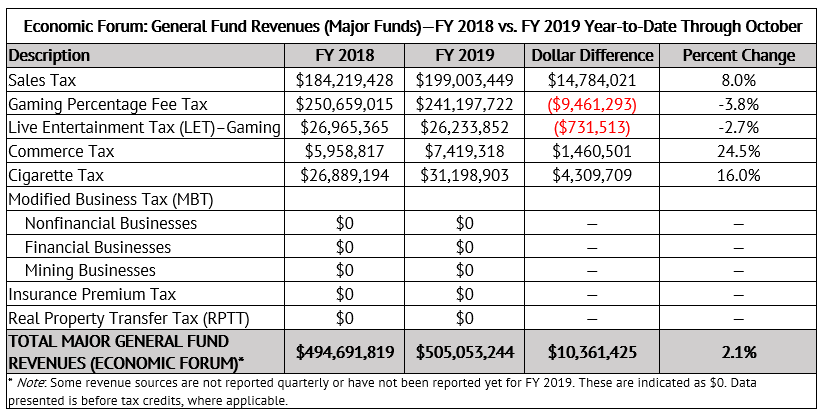

Table 2 presents FY 2018 and FY 2019 “actuals” through October, by source, for major General Fund revenues. The Guinn Center Silver State Snapshot©, “Nevada’s May 2017 Economic Forum,” released in 2017, provides background on each of the major funds. (See Appendix B for total FY 2018 major General Fund revenues.)

Table 2. Economic Forum: General Fund Revenues (Major Funds)—FY 2018 vs. FY 2019 Year-to-Date Through October

Source: Nevada Economic Forum Meeting Packet (November 8, 2018)

For the revenue major funds that are available, and like the revenue summary categories, all but the Gaming Percentage Fee Tax and the Live Entertainment Tax (LET)–Gaming increased in the same time frame in FY 2019 versus the same time frame in FY 2018. Notably the Sales Tax increased by about $14.8 million (8.0 percent), the Commerce Tax increased by approximately $1.5 million (24.5 percent), and the Cigarette Tax increased by roughly $4.3 million (16.0 percent).

Overall, growth in the majority of revenue summary categories and major funds seems to reflect current economic strength in Nevada. We will continue to follow the Economic Forum, so check back in December once the official forecasts for the General Fund have been approved and released.