by Tony S. Foresta

The Nevada Legislative Committee to Study Issues Regarding Affordable Housing held its third meeting of the 2017-2018 Interim on May 15, 2018. The Committee was established to discuss existing challenges and potential solutions related to affordable housing in Nevada. The Committee “…is required to conduct a study….and submit a report of the results of the study and recommend[ed] legislation to the 2019 Legislative Session.”

At the mid-May meeting, agencies and stakeholders throughout the state were invited to present their perspectives, research studies, and proposed strategies in an effort to build a comprehensive solution to meet the growing demand for affordable housing in the state.

Among the policy recommendations proposed during the meeting on Tuesday, May 15th were:

- Open federal land to allow for the additional construction of homes, consequently increasing the available supply of housing options.

- Reduce the fixed costs of housing production by allowing local communities greater flexibility to subsidize upfront building expenditures, which could encourage production.

- Leverage the Low-Income Housing Tax Credit (LIHTC) to encourage private investment in affordable housing units.

- Provide a significant increase in temporary housing solutions for temporary workers in northern Nevada, thereby reducing reliance on permanent housing.

- Enlist non-profit organizations and expand government programs to assist and provide low-income families with down payment options and advantageous mortgage rates.

- Amend the Medicaid 1915(i) to make supportive housing more accessible for individuals with disabilities and mental health conditions.

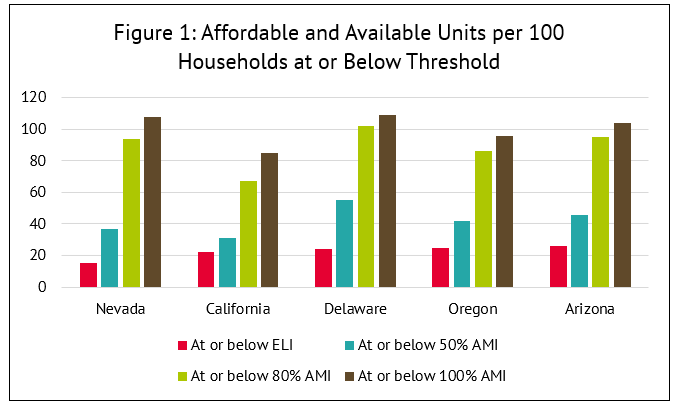

These recommendations come at a time when Nevada faces significant challenges with respect to its supply of affordable housing. A 2018 report by the National Low Income Housing Commission (NLIHC) reveals that Nevada ranks last in the United States when it comes to providing affordable housing to households who earn at the “extremely low income” (ELI) level, which is at or below 30 percent of the area median income (AMI). The report found that there are only 15 affordable housing options for every 100 ELI households in Nevada, compared to the U.S. total of 35 homes per 100 households for the same household demographic, i.e., at or below ELI. Figure 1 below illustrates the bottom 5 performers in the United States with respect to this demographic.

Data Source: National Low-Income Housing Coalition

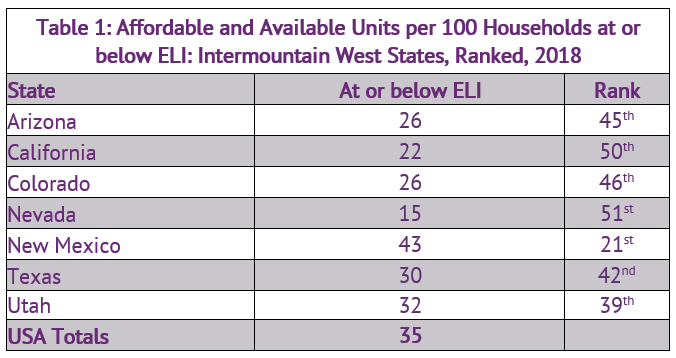

To see how Nevada compares to other Intermountain West states, consider Table 1 below. With the exception of New Mexico and Utah, which are ranked at 21st and 39th, respectively, all of the Intermountain West states place among the bottom 10 states in the United States and the District of Columbia when it comes to providing affordable housing to ELI households.

Data Source: National Low-Income Housing Coalition

As housing prices continue to rise in Nevada and access to homes for low-income individuals is reduced, the need for affordable housing becomes even more salient. To be sure, a pragmatic and comprehensive solution likely includes a combination of both supply-side strategies – increasing the availability of homes in the region – and demand-side strategies – increasing the affordability of existing homes in the region. Let’s consider and elaborate what these strategies might look like.

Supply-Side Policy Solutions

One popular policy solution is to open access to federal land with the intention of increasing housing supply, subsequently placing downward pressure on prices. Economic theory and principles of supply and demand would suggest that, all else equal, if housing demand increases faster than supply in a typical market, prices will inevitably rise. But if Nevada enacts policies that increase the housing supply and offset the increase in demand, prices could theoretically stabilize, and relative affordability of these units could be maintained.

However, this simple theoretical model may not fully and adequately describe the empirically observed outcomes of the market. While building additional housing units may place some downward pressure on overall average prices, newly constructed homes are typically not within an affordable range for households earning below median income in the region. High upfront costs of constructing new housing units (e.g., labor, materials, land prices, etc.) may result in prices far above what low-income individuals can afford. This issue could potentially be partially mitigated by subsidizing the construction process, as was explained in the committee hearing by Bill Thomas, Assistant City Manager for the City of Reno. Given that the upfront costs associated with building new units are increasing in our state, according to the experts who testified, some form of subsidy to developers could help spur more housing development as well as result in a lower sale price.

A more direct approach to the growing affordable housing problem in Nevada is encouraging the construction of additional affordable housing units. Nevada HAND, which provides affordable housing solutions in Nevada, testified at the committee hearing that the organization plans to add 6,000 units by the year 2025. HAND currently manages nearly 4,200 affordable housing units in southern Nevada, which comprises nearly half of all affordable housing stock in the region. As recommended by NLIHC, opening federal lands to affordable housing development could prove to have a substantial impact on serving low-income families in their search for affordable housing.

Demand-Side Policy Solutions

Several non-profit organizations and government programs provide financial assistance to qualified households to help make homes more affordable. For example, Home Is Possible, a state governmental program established by the state of Nevada in 2014, provides assistance to educators, veterans, and low-income households. Individuals and families meeting the program criteria are eligible for assistance with closing costs, down payments, and obtaining competitive interest rates. The Nevada Affordable Housing Assistance Corporation, a partner of the Nevada Hit Hardest Fund, recently established the Hope Brings You Home program, which provides qualified homebuyers with substantial assistance with down payments for homes. The program offers to pay 10 percent of the cost of the home, up to $20,000, and will be available until its $36 million of allocated funds are exhausted.

During the committee hearing, members from Nevada’s Department of Health and Human Services (DHHS) discussed their proposal to amend the Medicaid 1915(i) to include greater accessibility to supportive housing and other Home- and Community-Based Services (HCBS). Stephanie Woodard, Co-occurring Disorders (COD) Program Director for the Nevada Division of Public and Behavioral Health, testified that approximately 75 percent of the homeless population have either a serious disability or mental health condition. Establishing a more comprehensive supportive housing system that is targeted at assisting these vulnerable individuals could reduce the demand for affordable housing units in Nevada. As explained in the committee hearing by Julia Kotchevar, administrator at the Nevada DHHS, every Medicaid dollar spent on supportive housing is a dollar not spent on affordable housing.