Property Taxes & K-12 Financing in Nevada

Property tax is one of the most significant sources of K-12 education financing within states. In Nevada, property taxes supply budgetary support for local governments, such as school districts. While local jurisdictions have some discretion in setting property tax rates, there are legal constraints on rate setting for school districts. In particular, Nevada law requires that 75 cents per $100 of assessed valuation of the combined property tax rate must be levied for school operating costs. This rate cannot vary by school district. The Silver State’s primary funding mechanism for K-12 education is called the Nevada Plan, which establishes a basic support guarantee for each school district. Property tax revenues collected from one-third of the school tax operating rate are guaranteed by the State by virtue of being inside the Nevada Plan. Revenues realized from the two-thirds are retained by the school district as they are not part of the guarantee.

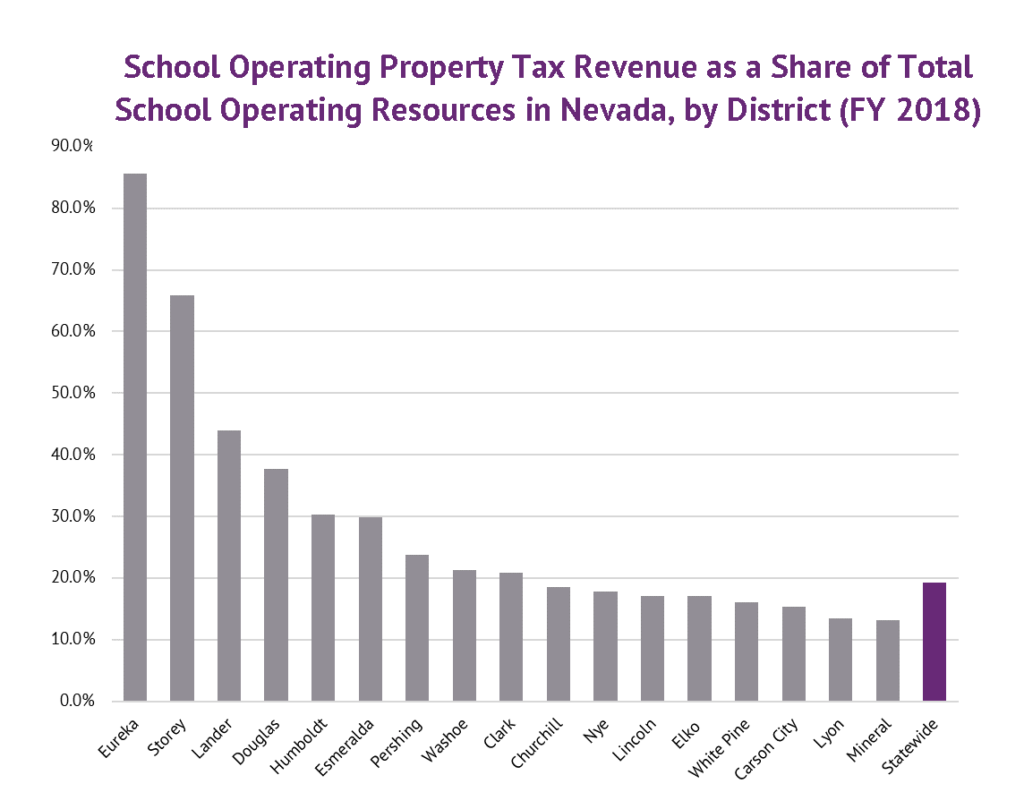

In fiscal year (FY) 2018, property taxes contributed roughly $677.8 million (19.2 percent) to total statewide school operating resources. Property tax revenue as a share of total school operating resources is comparatively low at the school district level, though there are some exceptions. Eureka County School District and Storey County School District are the only school districts in Nevada in which property taxes contribute the majority (50 percent or more) of revenue to school operating resources.

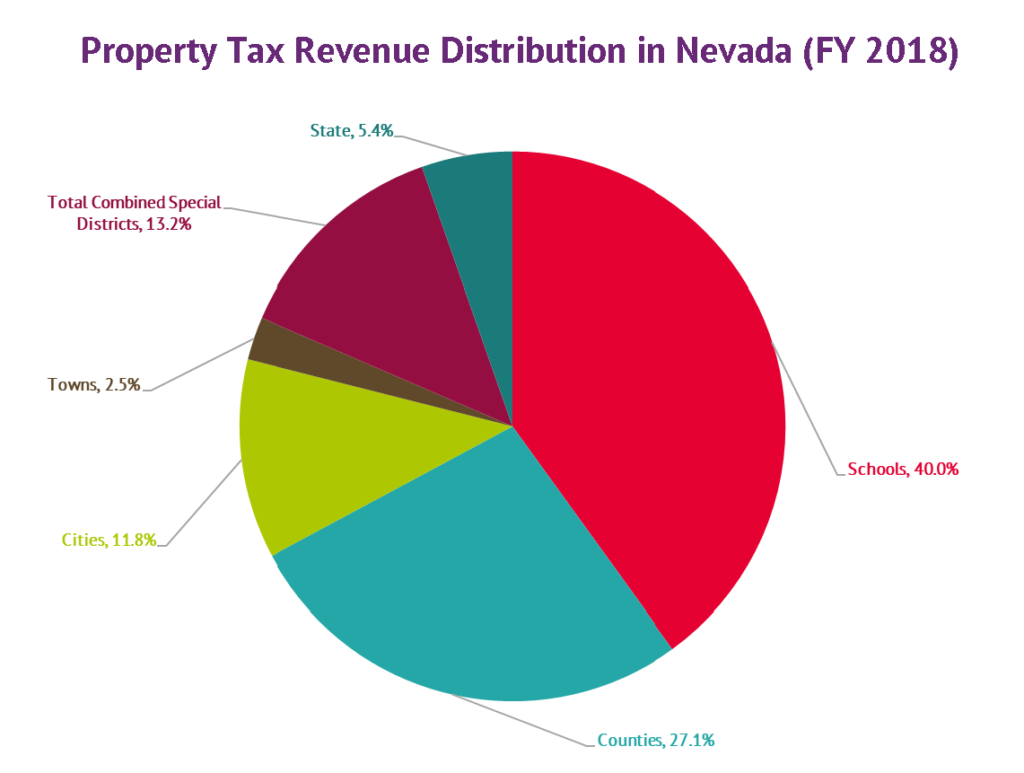

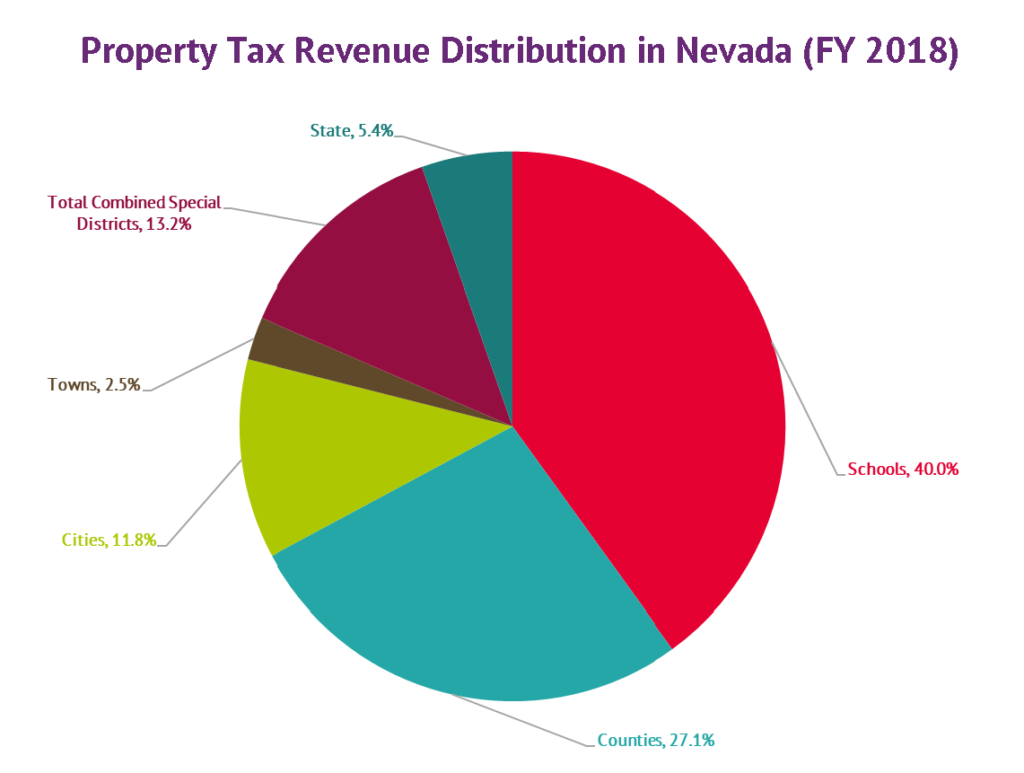

For fiscal year (FY) 2018, Nevada school districts’ total resources—amounts realized from both the school operating tax and the school debt service tax—equaled $6.9 billion when aggregated statewide. Property taxes contributed about $1.1 billion (16.4 percent) to total resources. However, while schools are not very reliant on property tax revenue, most property tax collections are apportioned to school districts. Schools were the largest beneficiary of property tax dollars in FY 2018; forty (40.0) percent all property tax money collected statewide in FY 2018 was distributed to school districts.

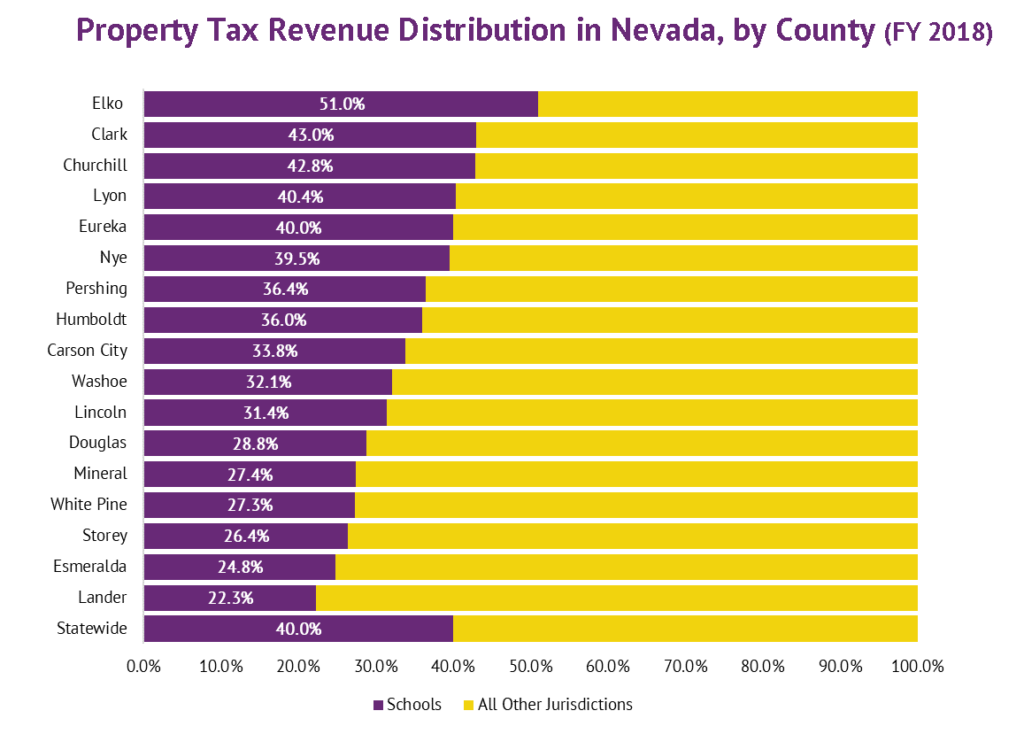

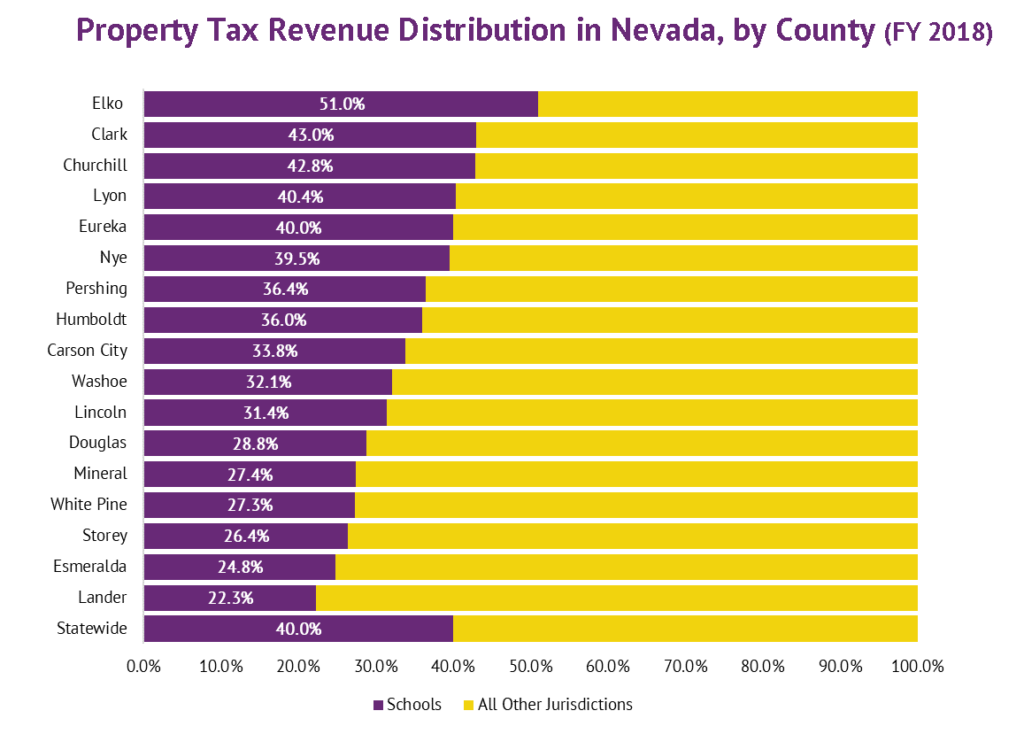

Six counties in Nevada distributed property tax revenue to school districts in shares that were approximately equal to or greater than the statewide aggregate of 40.0 percent in fiscal year (FY) 2018: Elko (51.0 percent), Clark (43.0 percent), Churchill (42.8 percent), Lyon (40.4 percent), and Eureka (40.0 percent). Lincoln, Washoe, Carson City, Humboldt, and Pershing allocated about one-third of all property tax revenue to school districts—give or take a few percentage points—while the remaining counties (Lander, Esmeralda, Storey, White Pine, Mineral, and Douglas) apportioned property taxes in amounts greater than 20.0 percent but less than 30.0 percent.

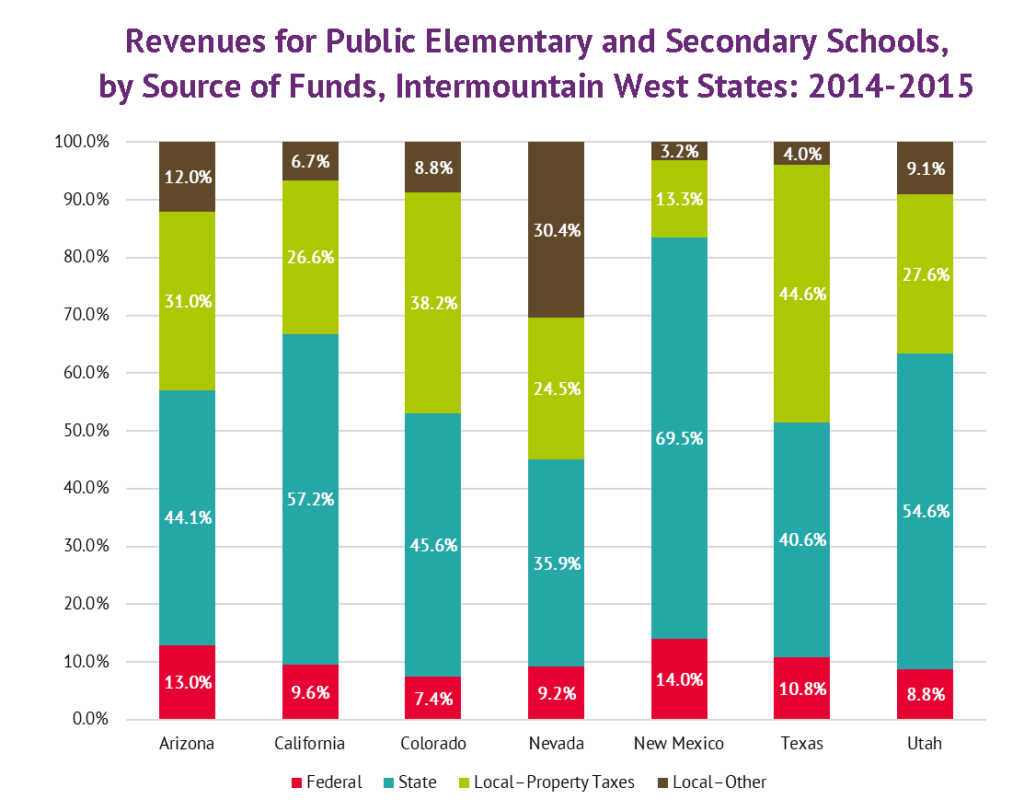

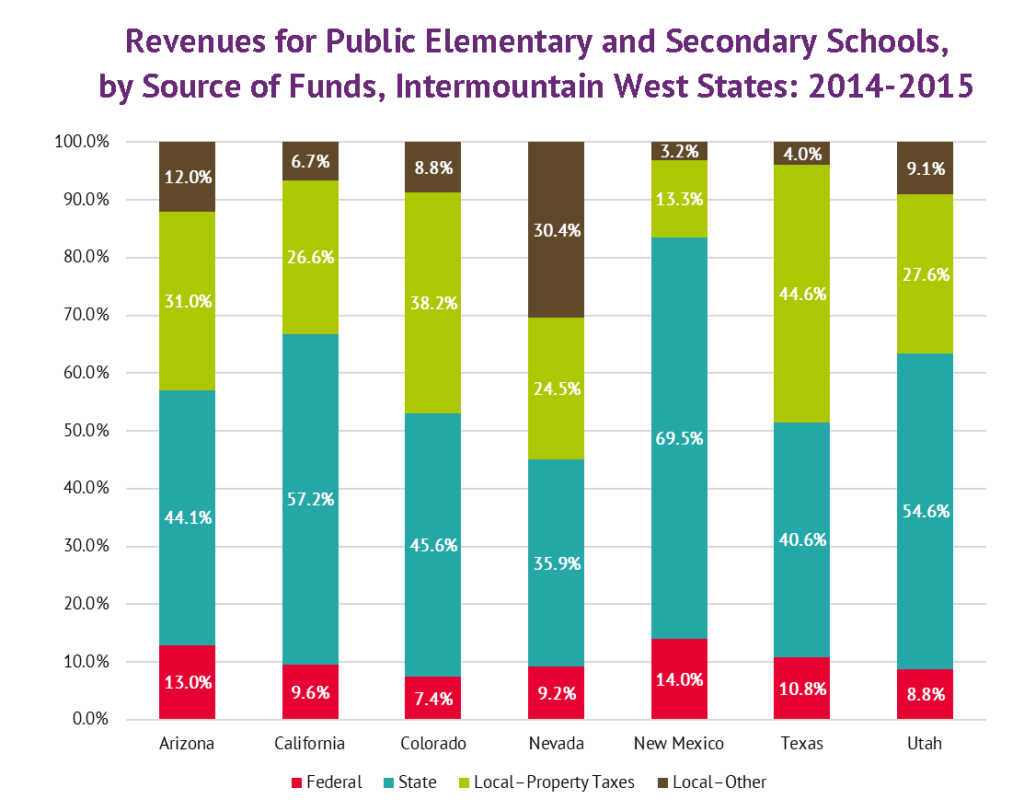

Nationwide, Nevada is one of the least dependent states on property taxes as a source of local school revenue, though it is one of the most dependent of all states for local revenues to finance elementary and secondary school education. Local revenues ($2.5 billion) in Nevada comprised a majority share of all school revenues in 2014-2015 at 54.9 percent. By way of comparison in the Intermountain West, the next-highest state, Texas (48.6 percent) did not contribute a majority to all revenue from local resources; nor did Colorado (47.0 percent), Arizona (43.0 percent), Utah (36.7 percent), California (33.3 percent), and New Mexico (16.5 percent).