Nevada Budget Overview

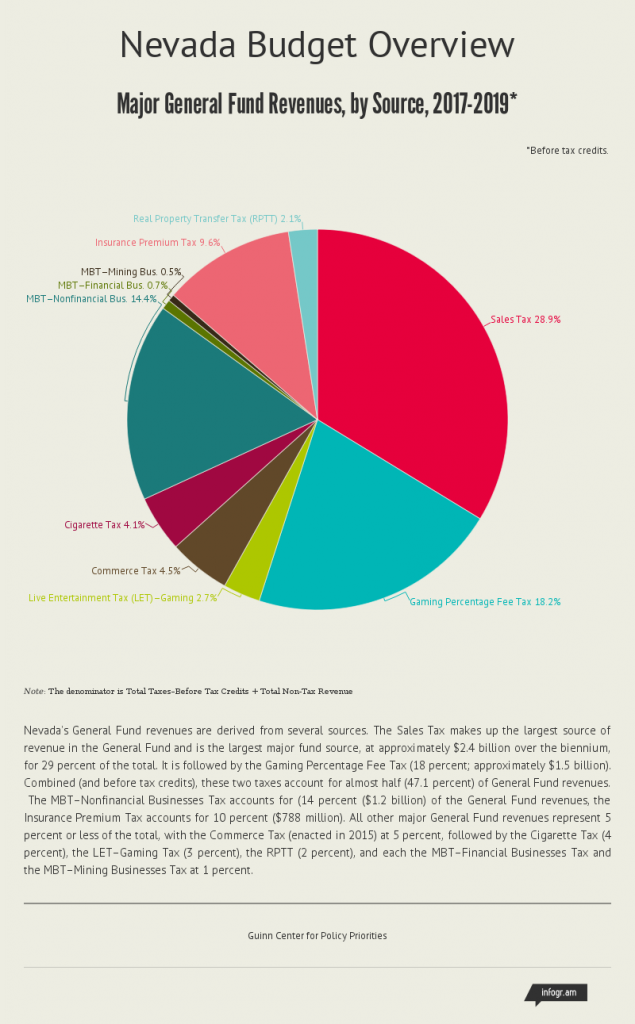

Nevada’s General Fund revenues are derived from several sources. The Sales Tax makes up the largest source of revenue in the General Fund and is the largest major fund source, at approximately $2.4 billion over the biennium, for 29 percent of the total. It is followed by the Gaming Percentage Fee Tax (18 percent; approximately $1.5 billion). Combined (and before tax credits), these two taxes account for almost half (47.1 percent) of General Fund revenues. The MBT–Non-financial Business Tax accounts for (14 percent ($1.2 billion) of the General Fund revenues, the Insurance Premium Tax accounts for 10 percent ($788 million). All other major General Fund revenues represent 5 percent or less of the total, with the Commerce Tax (enacted in 2015) at 5 percent, followed by the Cigarette Tax (4 percent), the LET–Gaming Tax (3 percent), the RPTT (2 percent), and each the MBT–Financial Businesses Tax and the MBT–Mining Businesses Tax at 1 percent.

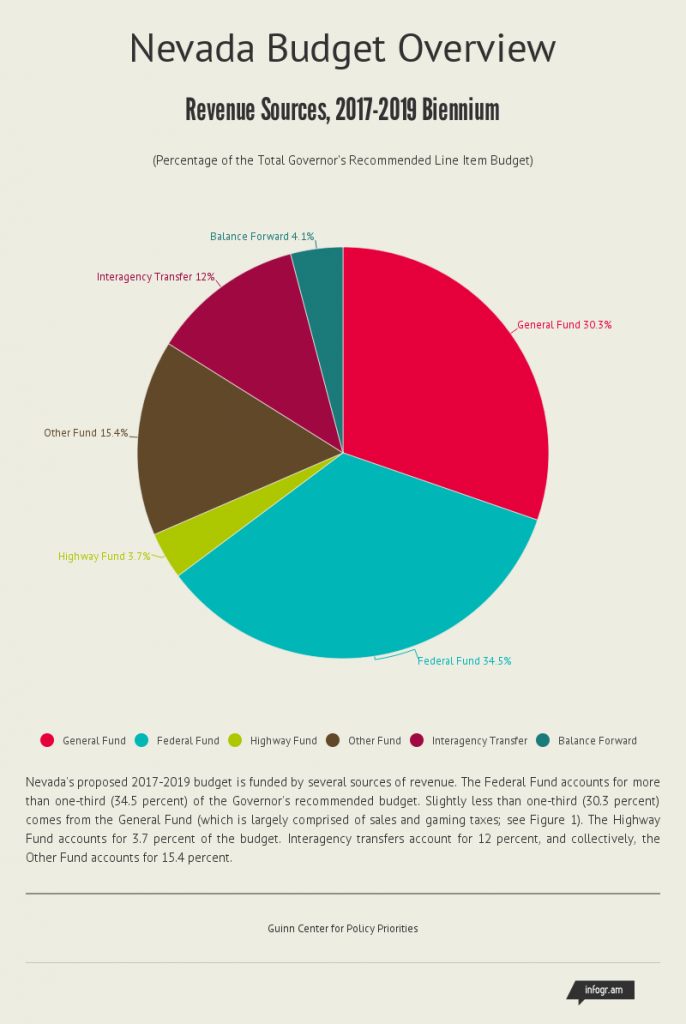

Nevada’s proposed 2017-2019 budget is funded by several sources of revenue. The Federal Fund accounts for more than one-third (34.5 percent) of the Governor’s recommended budget. Slightly less than one-third (30.3 percent) comes from the General Fund (which is largely comprised of sales and gaming taxes; see Figure 1). The Highway Fund accounts for 3.7 percent of the budget. Interagency transfers account for 12 percent, and collectively, the Other Fund accounts for 15.4 percent.

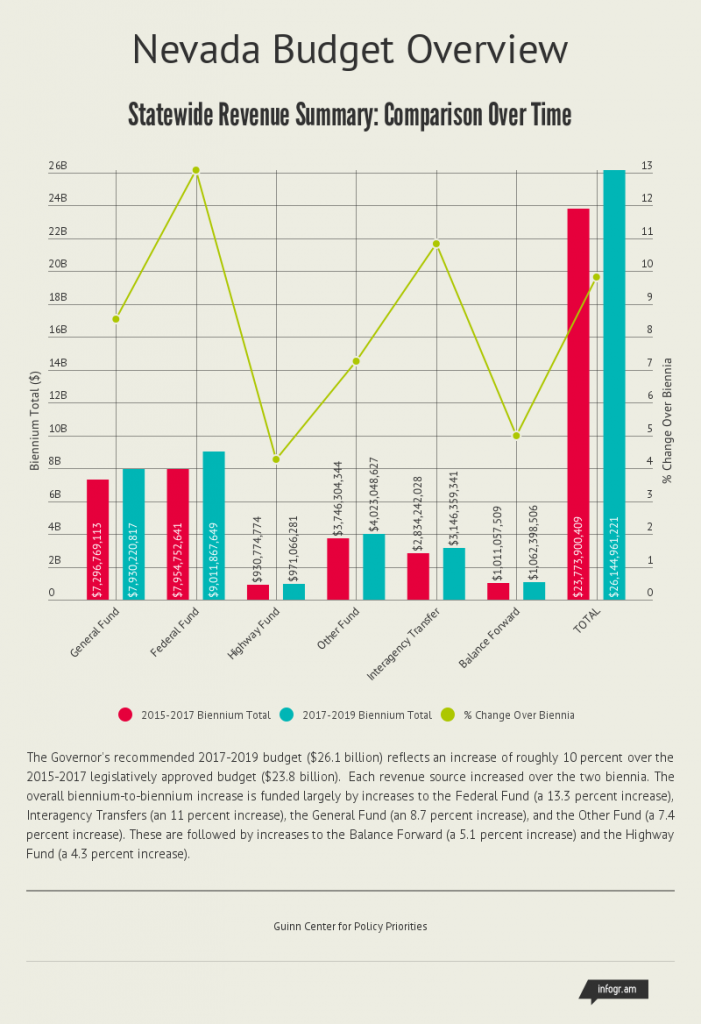

The Governor’s recommended 2017-2019 budget ($26.1 billion) reflects an increase of roughly 10 percent over the 2015-2017 legislatively approved budget ($23.8 billion). Each revenue source increased over the two biennia. The overall biennium-to-biennium increase is funded largely by increases to the Federal Fund (a 13.3 percent increase), Interagency Transfers (an 11 percent increase), the General Fund (an 8.7 percent increase), and the Other Fund (a 7.4 percent increase). These are followed by increases to the Balance Forward (a 5.1 percent increase) and the Highway Fund (a 4.3 percent increase).

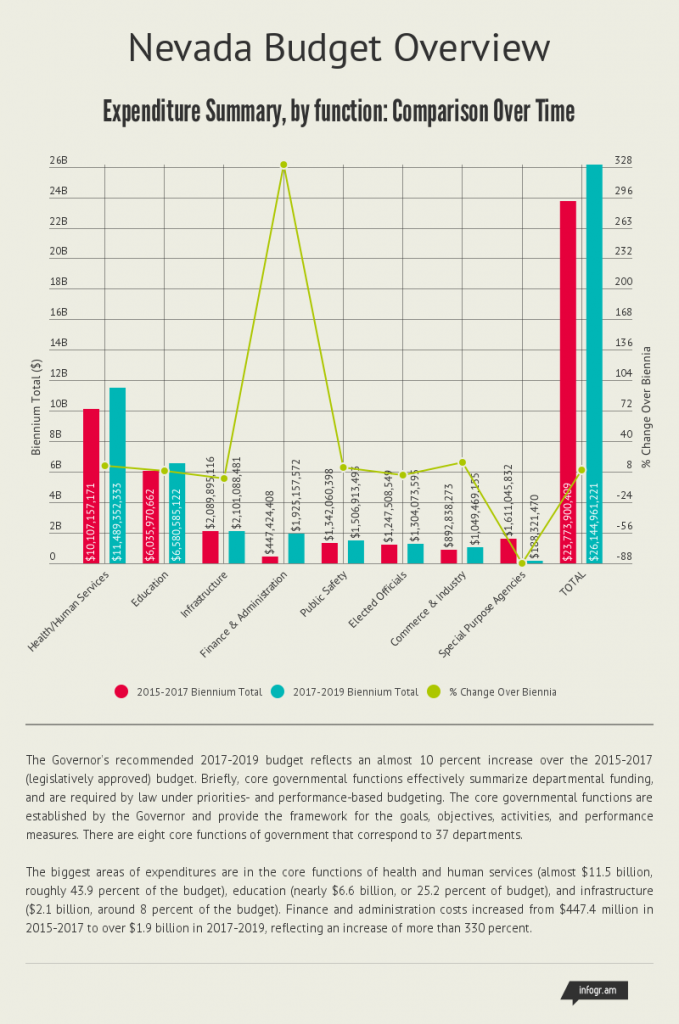

The Governor’s recommended 2017-2019 budget reflects a roughly 10 percent increase over the 2015-2017 (legislatively approved) budget. Briefly, core governmental functions effectively summarize departmental funding, and are required by law under priorities- and performance-based budgeting. The core governmental functions are established by the Governor and provide the framework for the goals, objectives, activities, and performance measures. There are eight core functions of government that correspond to 37 departments.

The biggest areas of expenditures are in the core functions of health and human services (almost $11.5 billion, roughly 43.9 percent of the budget), education (nearly $6.6 billion, or 25.2 percent of budget), and infrastructure ($2.1 billion, around 8 percent of the budget). Finance and administration costs increased from $447.4 million in 2015-2017 to over $1.9 billion in 2017-2019, reflecting an increase of more than 330 percent.

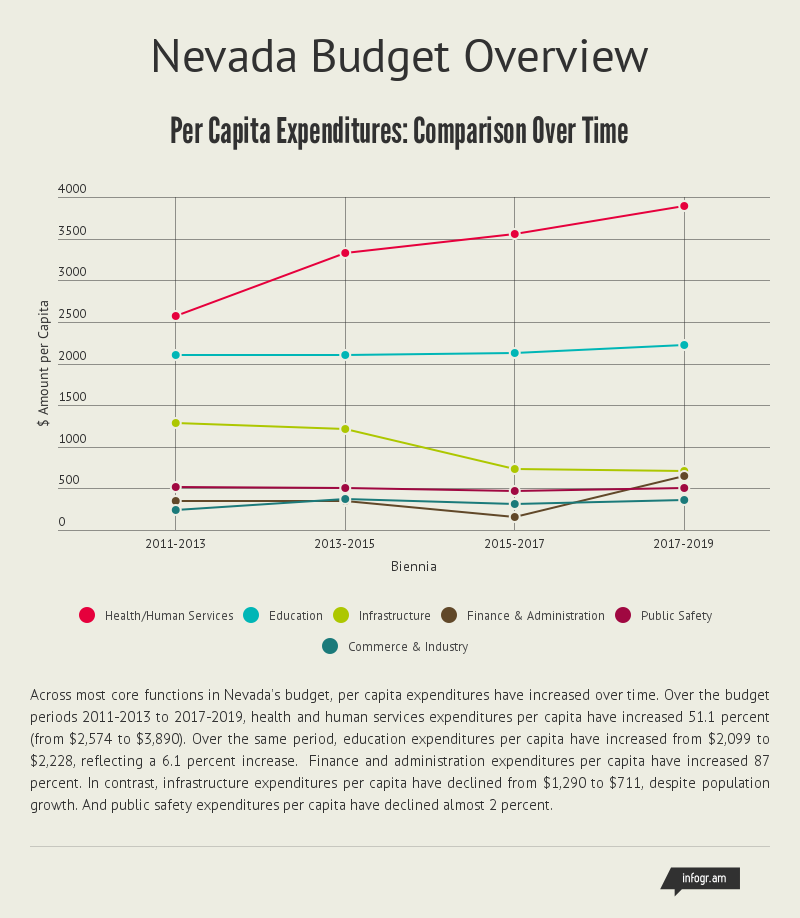

Across most core functions in Nevada’s budget, per capita expenditures have increased over time. Over the budget periods 2011-2013 to 2017-2019, health and human services expenditures per capita have increased 51.1 percent (from $2,574 to $3,890). Over the same period, education expenditures per capita have increased from $2,099 to $2,228, reflecting a 6.1 percent increase. Finance and administration expenditures per capita have increased 87 percent. In contrast, infrastructure expenditures per capita have declined from $1,290 to $711, despite population growth. And public safety expenditures per capita have declined almost 2 percent.

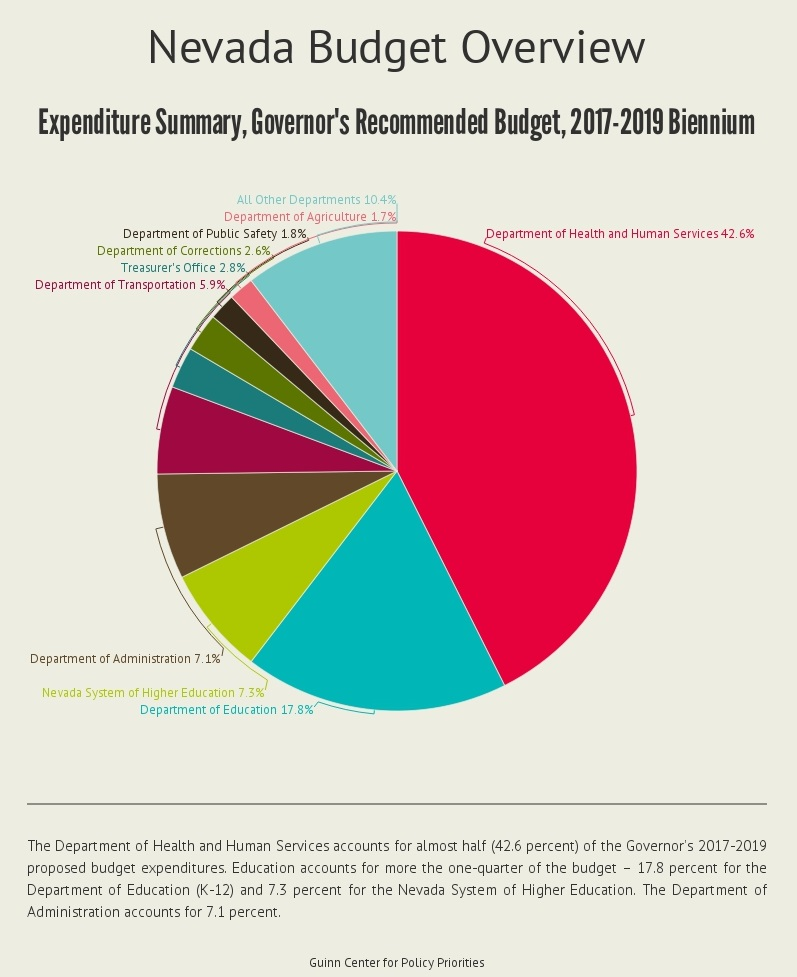

The Department of Health and Human Services accounts for almost half (42.6 percent) of the Governor’s 2017-2019 proposed budget expenditures. Education accounts for more the one-quarter of the budget – 17.8 percent for the Department of Education (K-12) and 7.3 percent for the Nevada System of Higher Education (NSHE). The Department of Administration accounts for 7.1 percent.

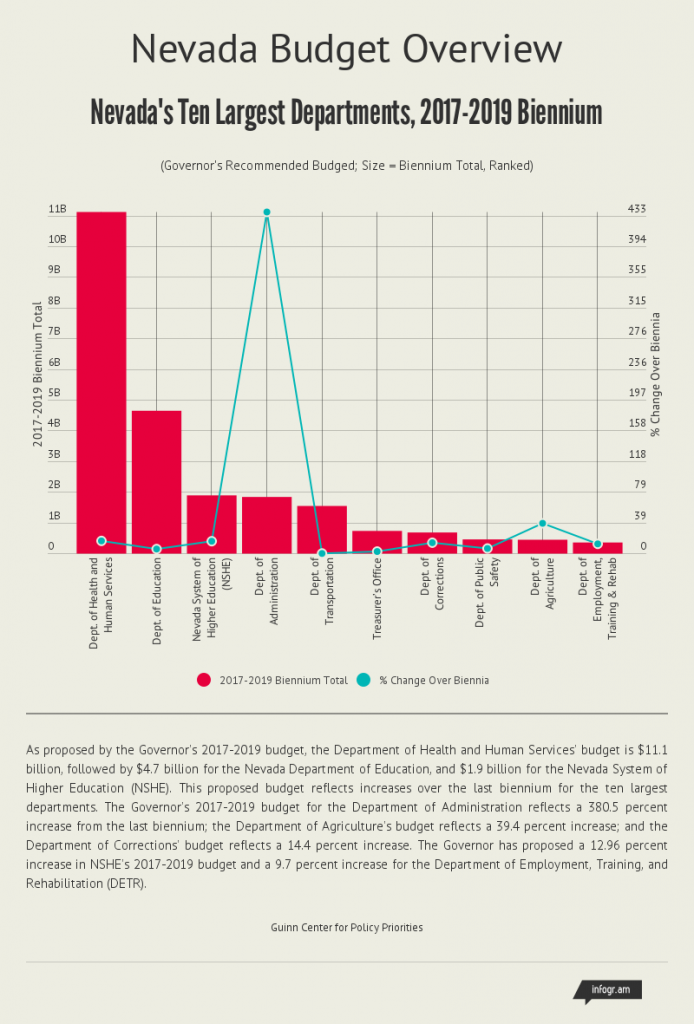

As proposed by the Governor’s 2017-2019 budget, the Department of Health and Human Services’ budget is $11.1 billion, followed by $4.7 billion for the Nevada Department of Education, and $1.9 billion for the Nevada System of Higher Education (NSHE). This proposed budget reflects increases over the last biennium for the ten largest departments. The Governor’s 2017-2019 budget for the Department of Administration reflects a 380.5 percent increase from the last biennium; the Department of Agriculture’s budget reflects a 39.4 percent increase; and the Department of Corrections’ budget reflects a 14.4 percent increase. The Governor has proposed a 12.96 percent increase in NSHE’s 2017-2019 budget and a 9.7 percent increase for the Department of Employment, Training, and Rehabilitation (DETR).

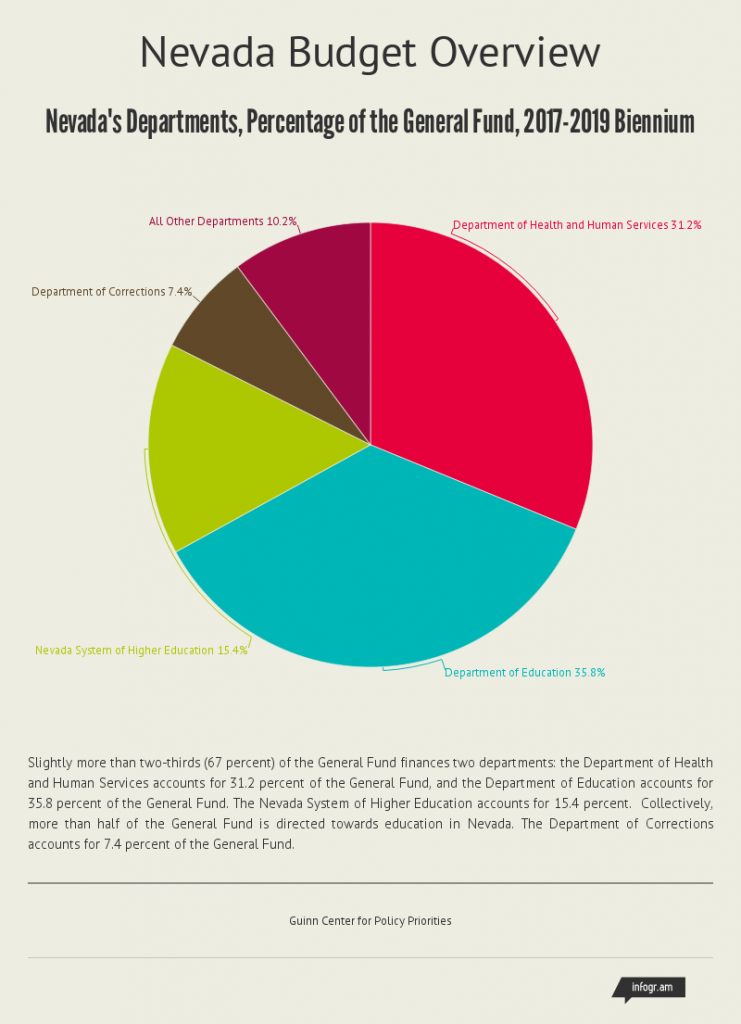

Slightly more than two-thirds (67 percent) of the General Fund finances two departments: the Department of Health and Human Services accounts for 31.2 percent of the General Fund, and the Department of Education accounts for 35.8 percent of the General Fund. The Nevada System of Higher Education accounts for 15.4 percent. Collectively, more than half of the General Fund is directed towards education in Nevada. The Department of Corrections accounts for 7.4 percent of the General Fund.

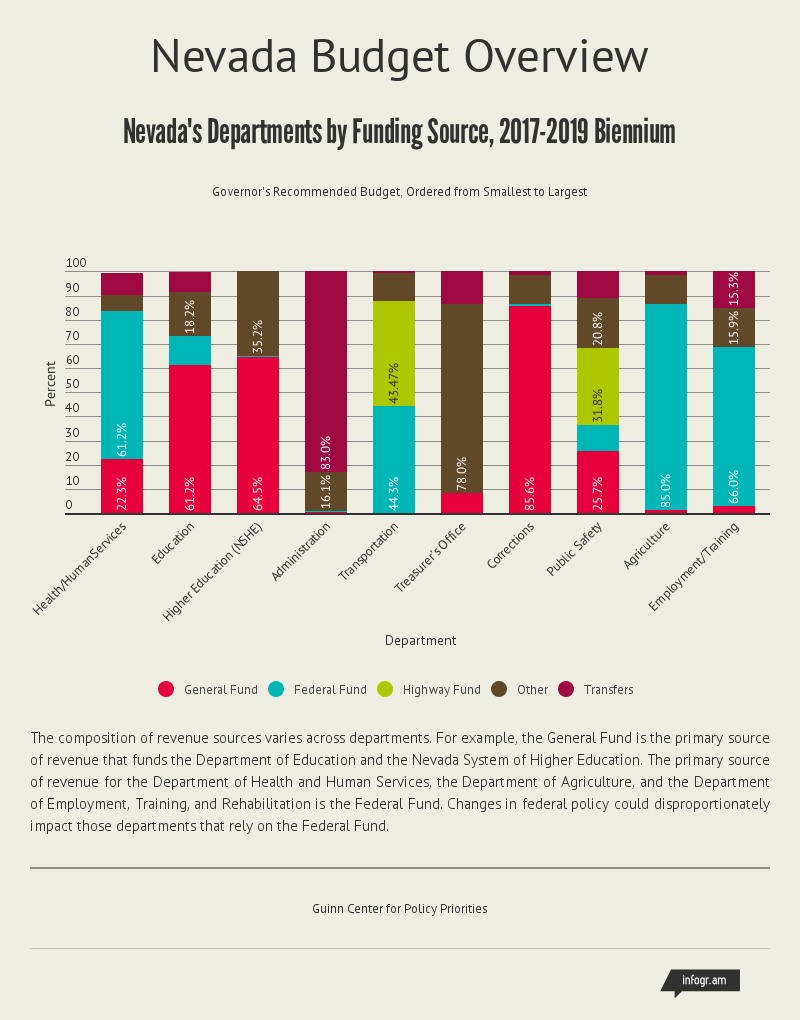

The composition of revenue sources varies across departments. For example, the General Fund is the primary source of revenue that funds the Department of Education and the Nevada System of Higher Education. The primary source of revenue for the Department of Health and Human Services, the Department of Agriculture, and the Department of Employment, Training, and Rehabilitation is the Federal Fund. Changes in federal policy could disproportionately impact those departments that rely on the Federal Fund.