Nevada Budget Overview 2019-2021

This set of infographics provides both a broad-based overview of budgetary sources and spending and a detailed account of revenues and proposed expenditures. You can find a pdf version of the infographics here: Guinn Center Nevada Budget 2019-2021 Infographics

Nevada’s General Fund revenues are derived from several sources. Sales and Use Taxes make up the largest source of revenue in the General Fund and the “State 2% Sales Tax” the largest major fund source, at approximately $2.6 billion over the biennium, for 29.0 percent of the total. It is followed by the Gaming Percentage Fee Tax (17.4 percent; approximately $1.6 billion). Combined (and before tax credits), these two taxes account for almost half (46.4 percent) of General Fund revenues. The MBT–Non-financial Business Tax accounts for (14.0 percent ($1.3 billion) of the General Fund revenues, the Insurance Premium Tax accounts for 10.5 percent ($950.7 million). All other major General Fund revenues represent 5 percent or less of the total, with the Commerce Tax (enacted in 2015) at 4.9 percent, followed by the RPTT (2.6 percent), the LET–Gaming Tax (2.2 percent), and then the MBT–Financial Businesses Tax, the LET–Nongaming Tax and the MBT–Mining Businesses Tax at less than one percent each.

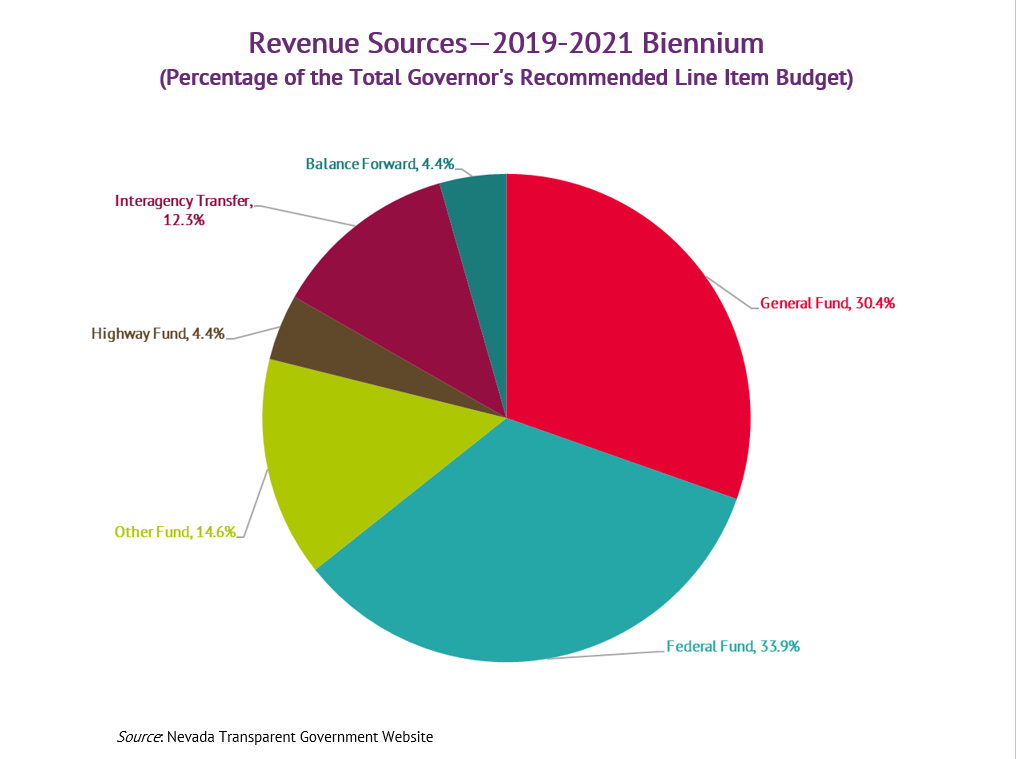

Nevada’s proposed 2019-2021 budget is funded by several sources of revenue. The Federal Fund accounts for more than one-third (33.9 percent) of the Governor’s recommended budget. Slightly less than one-third (30.4 percent) comes from the General Fund (which is largely comprised of sales and gaming taxes). The Highway Fund accounts for 4.4 percent of the budget. Interagency transfers account for 12.3 percent, and the Other Fund accounts for 14.6 percent.

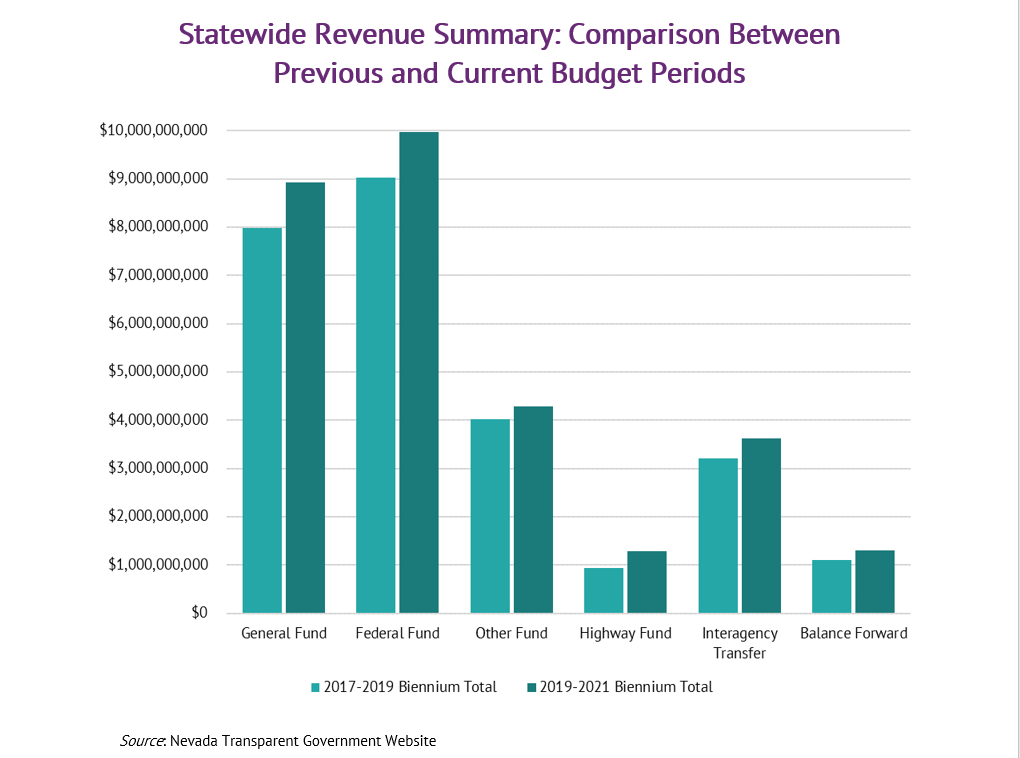

The Governor’s recommended 2019-2021 budget ($29.4 billion) reflects an increase of roughly 11.8 percent over the 2017-2019 legislatively approved budget ($26.3 billion). Each revenue source increased over the two biennia. The overall biennium-to-biennium increase is funded largely by increases to the Federal Fund (a $946.5 million increase; 10.5 percent), the General Fund (a $946.1 million increase; 11.8 percent), Interagency Transfers (a $413.2 million increase; 12.9 percent), and the Highway Fund (a $342.8 million increase; 36.3 percent). These are followed by increases to the Other Fund (a $257.4 million increase; 6.4 percent) and the Balance Forward (a $200.4 million increase; 18.2 percent).

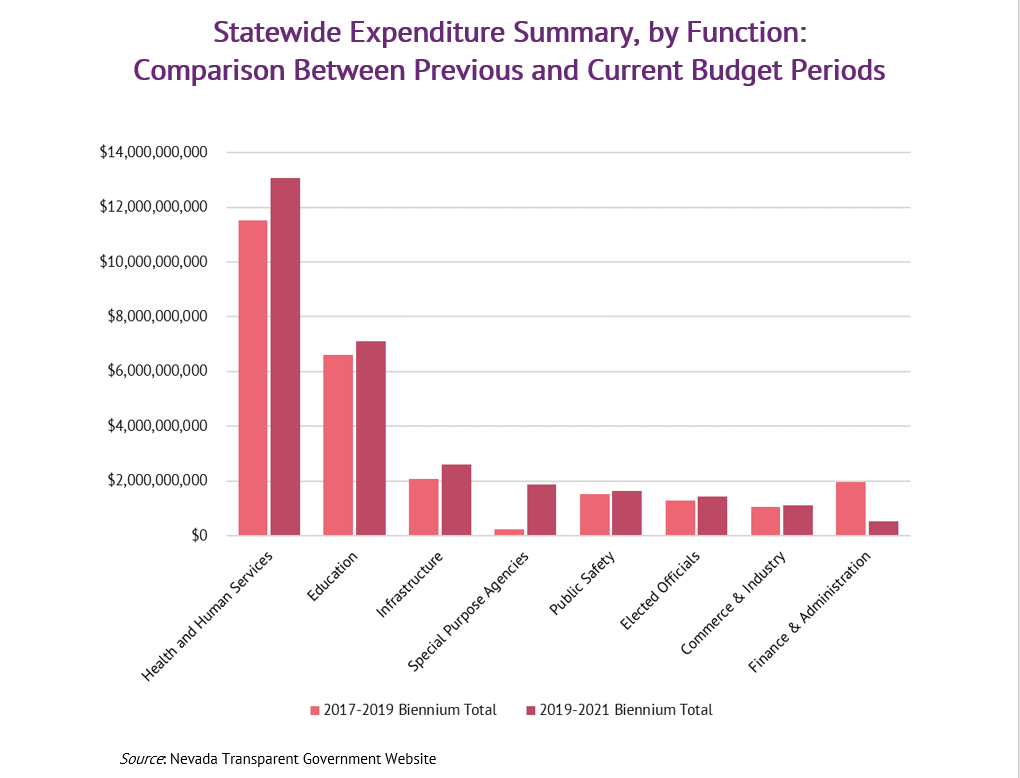

The Governor’s Recommended 2019-2021 budget reflects a roughly 11.8 percent increase over the 2017-2019 (legislatively approved) budget. Core governmental functions effectively summarize departmental funding and are required by law under priorities- and performance-based budgeting. There are eight core functions of government that correspond to 38 departments. The biggest areas of expenditures are in the core functions of health and human services ($13.1 billion, roughly 44.5 percent of the budget), education ($7.1 billion, or about 24.2 percent of budget), and infrastructure ($2.6 billion, around 8.9 percent of the budget). Special purpose agencies increased by 701.1 percent over the 2017-2019 biennium, while finance and administration decreased by 73.3 percent, which is the result of a departmental/programmatic reclassification to the former from the latter.

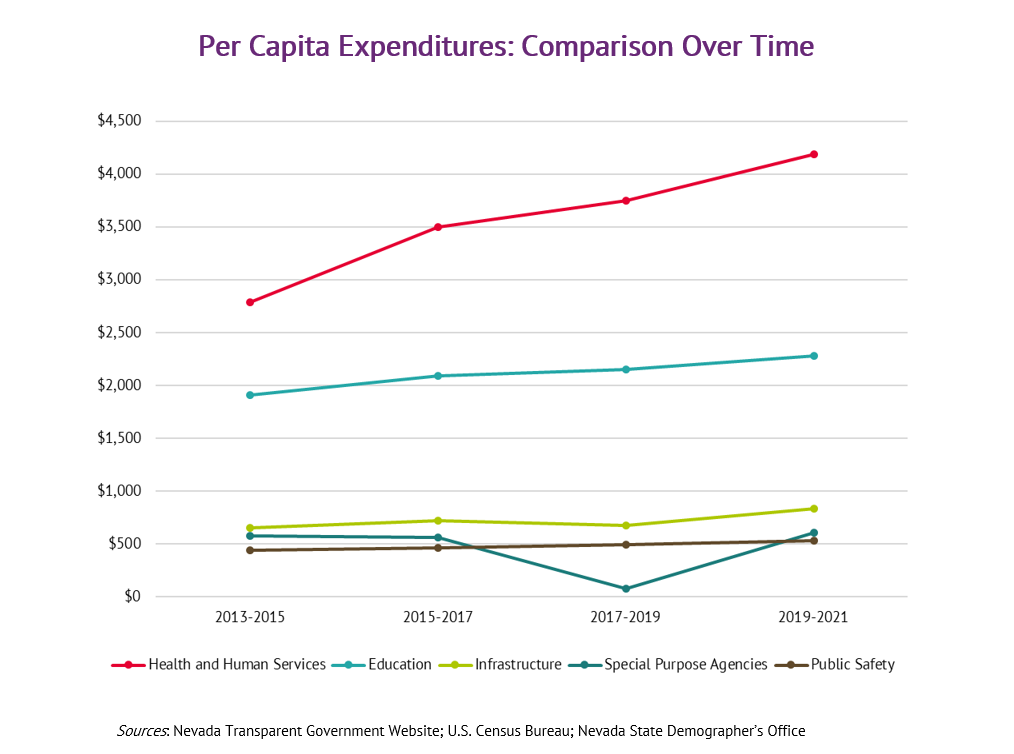

Across all core functions in Nevada’s budget, per capita expenditures have increased over time. Over the budget periods 2013-2015 to 2019-2021, health and human services expenditures per capita have increased 50.5 percent (from $2,786 to $4,191). Over the same period, education expenditures per capita have increased from $1,910 to $2,278, reflecting a 19.3 percent increase. Infrastructure expenditures per capita have increased 28.9 percent. Public safety expenditures per capita increased modestly from $438 to $530. And though expenditures per capita for special purpose agencies increased from the 2013-2015 biennium to the 2019-2021 biennium (4.5 percent), there was a decline in legislatively appropriated funding in the current (2017-2019) biennium.

The Department of Health and Human Services accounts for almost half (43.2 percent) of the Governor’s 2019-2021 proposed budget expenditures. Education accounts for just less than one-quarter of the budget – 16.7 percent for the Department of Education (K-12) and 7.3 percent for the Nevada System of Higher Education (NSHE). The Department of Transportation accounts for 6.9 percent.

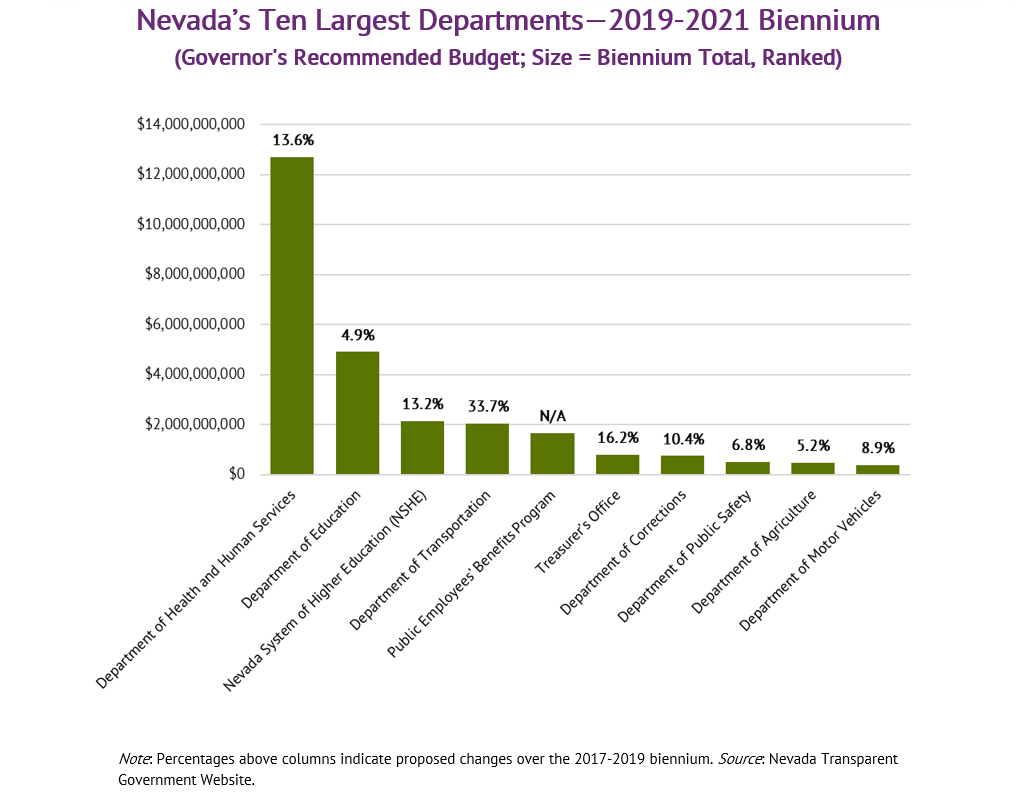

As proposed by the Governor’s 2019-2021 budget, the Department of Health and Human Services’ budget is $12.7 billion, followed by $4.9 billion for the Nevada Department of Education, and $2.1 billion for the Nevada System of Higher Education (NSHE). This proposed budget reflects increases over the last biennium for the ten largest departments. The Governor’s 2019-2021 budget for the Department of Transportation reflects a 33.7 percent increase from the 2017-2019 biennium; the Department of Corrections’ budget reflects a 10.4 percent increase; and the Department of Public Safety’s budget reflects a 6.8 percent increase. The Governor has proposed a 13.2 percent increase in NSHE’s 2019-2021 budget and an 8.9 percent increase for the Department of Motor Vehicles.

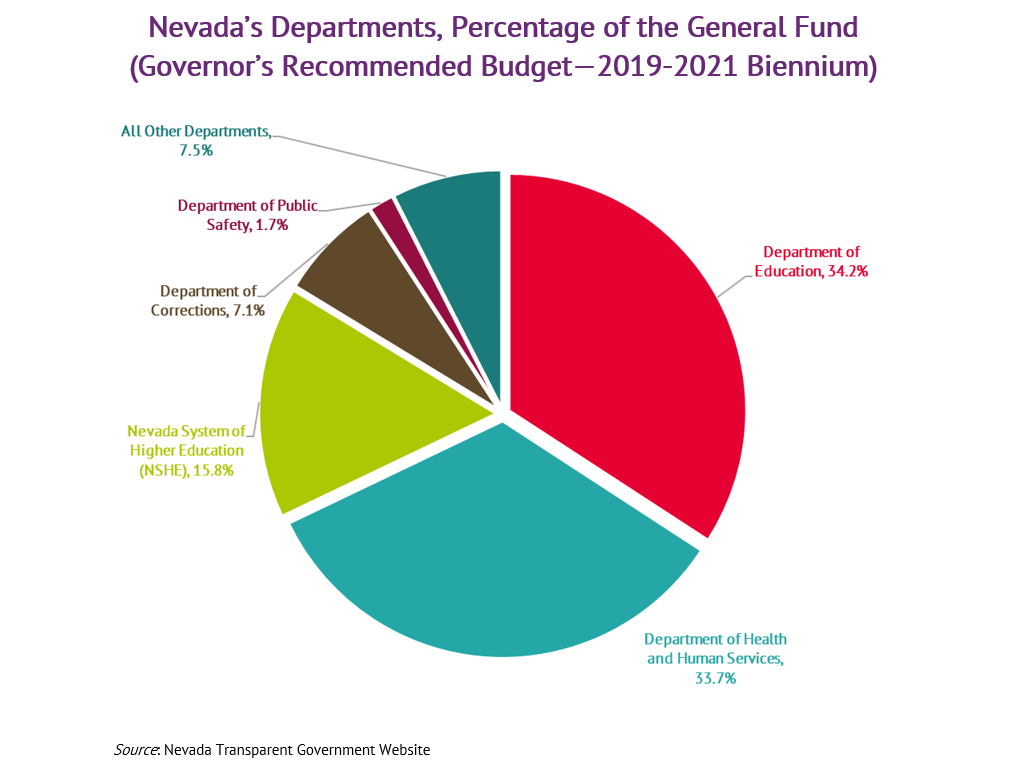

More than two-thirds (67.9 percent) of the General Fund finances two departments: the Department of Education accounts for 34.2 percent of the General Fund and the Department of Health and Human Services accounts for 33.7 percent of the General Fund. The Nevada System of Higher Education accounts for 15.8 percent. Collectively, about half of the General Fund is directed towards education in Nevada. The Department of Corrections accounts for 7.1 percent of the General Fund.

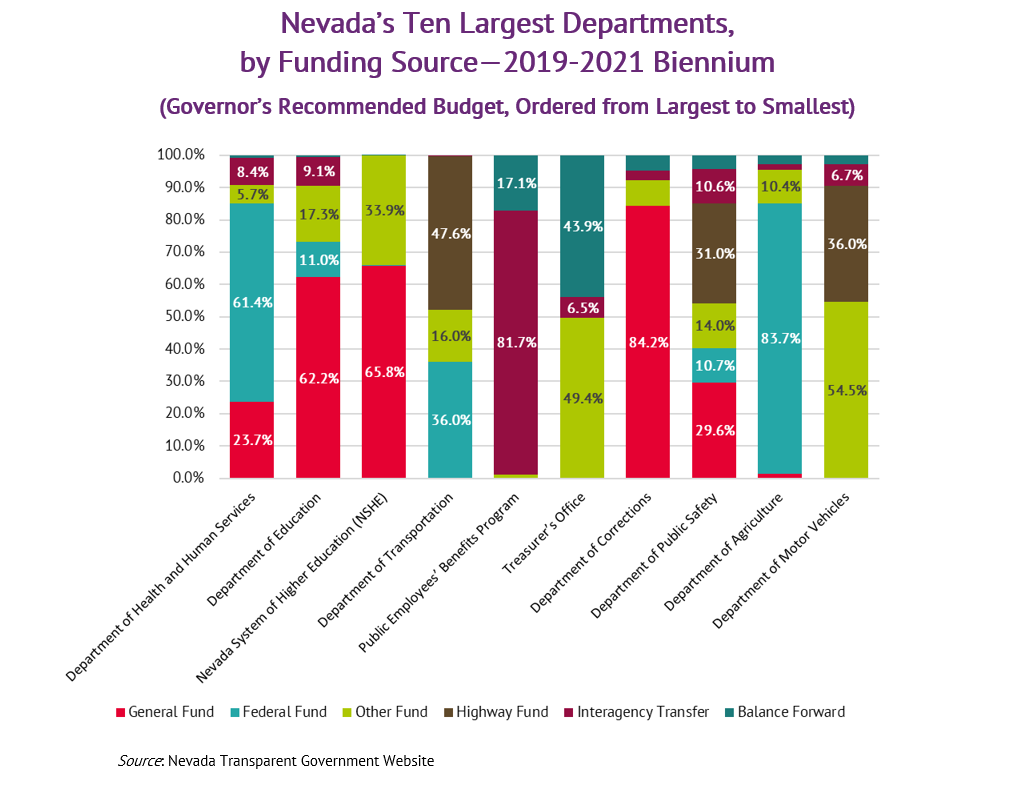

The composition of revenue sources varies across departments. For example, the General Fund is the primary source of revenue that funds the Department of Education and the Nevada System of Higher Education. The primary source of revenue for the Department of Health and Human Services and the Department of Agriculture is the Federal Fund. Changes in federal policy could disproportionately impact those departments that rely on the Federal Fund.