Last month, Prosperity Now (formerly Corporation for Enterprise Development or CFED) released its annual Prosperity Now scorecard, as discussed in the companion report, On Track or Left Behind. Nevada’s cumulative rank was #46, based on scores in 5 policy areas: (1) Financial Assets and Income (rank #43), (2) Businesses and Jobs (rank #45), (3) Homeownership and Housing (rank #46), (4) Healthcare (rank #34), and (5) Education (rank #43). Nevada’s 2017 ranking is two places higher than the 2015 and 2016 ranking of #48. Nevada’s decision to expand Medicaid accounts for its higher health ranking, relative to the other four categories.

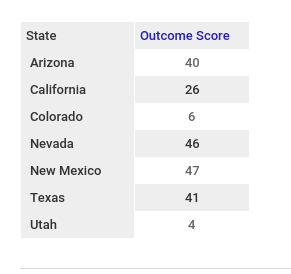

Data reveals there is tremendous variation in Prosperity Now’s scorecard among the Intermountain West states (see Table 1). Nevada ranks #46, followed by New Mexico at #47. In contrast, Colorado and Utah have significantly higher scores at #6 and #4, respectively.

Table 1. Prosperity Now Overall Outcome Score in Intermountain West States, 2017

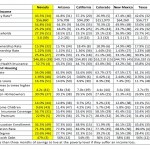

Table 2 presents a selection the specific outcomes in the five broad categories for states in the Intermountain West. Nevada has the highest percentage of underbanked households in the country, defined as households that have a checking or savings account, but who also obtain financial products and services outside of the banking system (e.g., pay day loan, title loan, etc.). More than half (52.7 percent) of employers offer health insurance in Nevada, the highest rate in the region and #4 in the country.

Nevada ranks #50 in the small business ownership rate. The Silver State ranks #48 in the homeownership rate; only 54 percent of all households own homes. High cost mortgage loans account for 16.3 percent of all mortgage loans, ranking Nevada #51 in the country.

Table 2. Outcomes, Intermountain West States, 2017

Recent legislative reforms in Nevada could improve economic prosperity outcomes among Nevadans.

- Senate Bill 118: This bill established the Task Force on Financial Security whose charge is to conduct an examination during the legislative interim of the financial security of individuals and families in Nevada.

- Assembly Bill 163: This bill revises existing provisions around a customer’s ability to (re) pay a high-interest loan, and revises restrictions on the issuance of title loans.

- Senate Bill 249: This bill requires instruction on financial literacy in public middle and elementary schools.

- Senate Bill 126: This bill requires the Governor’s Office of Economic Development (GOED) to develop and implement a loan program (2017-2019 appropriation of $1,000,000) for small businesses, minority-owned business enterprises, women-owned business enterprises, and disadvantaged business enterprises.

- Senate Concurrent Resolution (SCR1): This measure directs the Legislative Commission to appoint a committee to conduct an interim study addressing affordable housing in Nevada.

- Senate Bill 391: This bill establishes the Nevada Promise Program, which requires the State to pay college registration fees and tuition at Nevada’s community colleges not previously covered by other forms of federal and state financial aid (e.g., federal Pell grant, Silver State Opportunity Grant, and Millennium Scholarship, etc.).

Other reforms seeking to address financial security failed to pass, however. Assembly Bill 515, which failed to pass, would have created a database of payday, high-interest, and title loans issued in Nevada for the purpose of determining the demand for such products. Groups such as the Opportunity Alliance Nevada and the Legal Aid Center of Southern Nevada continue to work to identify and support policies that could increase the long term economic security of Nevadans.